Solutions to Assignments

IBO-06 - INTERNATIONAL BUSINESS FINANCE

Master of Commerce (M.Com) - 1st Year

Question No. 1

a) What were the distinctive features of Breton Woods System.

The Bretton Woods Agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. Thus, the name “Bretton Woods Agreement.

Under the Bretton Woods System, gold was the basis for the U.S. dollar and other currencies were pegged to the U.S. dollar’s value. The Bretton Woods System effectively came to an end in the early 1970s when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency.

Approximately 730 delegates representing 44 countries met in Bretton Woods in July 1944 with the principal goals of creating an efficient foreign exchange system, preventing competitive devaluations of currencies, and promoting international economic growth. The Bretton Woods Agreement and System were central to these goals. The Bretton Woods Agreement also created two important organizations—the International Monetary Fund (IMF) and the World Bank. While the Bretton Woods System was dissolved in the 1970s, both the IMF and World Bank have remained strong pillars for the exchange of international currencies.

Though the Bretton Woods conference itself took place over just three weeks, the preparations for it had been going on for several years. The primary designers of the Bretton Woods System were the famous British economist John Maynard Keynes and American Chief International Economist of the U.S. Treasury Department Harry Dexter White. Keynes’ hope was to establish a powerful global central bank to be called the Clearing Union and issue a new international reserve currency called the bancor. White’s plan envisioned a more modest lending fund and a greater role for the U.S. dollar, rather than the creation of a new currency. In the end, the adopted plan took ideas from both, leaning more toward White’s plan.

Following were the features of Bretton Woods Agreement:

i Bretton Woods agreement was signed among the world powers in 1944.

ii This agreement established IMF and World Bank to preserve economic stability in the world.

iii Decision making in Bretton Woods Institutions was controlled by the Western Industrial powers.

iv National currencies followed the fixed exchange rates.

v It led to an era of unprecedented growth of trade and incomes.

b) Briefly discuss the various money market instruments with their purpose.

The term ‘Money Market’, according to the Reserve Bank of India, is used to define a market where short-term financial assets are traded. These assets are a near substitute for money and they aid in the money exchange carried out in the primary and secondary market. So, essentially, the money market is an apparatus which facilitates the lending and borrowing of short-term funds, which are usually for a duration of under a year. Short maturity period and high liquidity are two characteristic features of the instruments which are traded in the money market. Institutions like commercial banks, non-banking finance corporations (NBFCs) and acceptance houses are the components which make up the money market.

The money market is a part of the larger financial market and consists of numerous smaller sub-markets like bill market, acceptance market, call money market, etc. Money market deals are not carried out in money / cash, but other instruments like trade bills, government papers, promissory notes, etc. Also, money market transactions cannot be done via brokers but have to be carried out via mediums like formal documentation, oral or written communication.

Types Of Money Market Instruments

1. Treasury Bills (T-Bills)

Issued by the Central Government, Treasury Bills are known to be one of the safest money market instruments available. However, treasury bills carry zero risk. I.e. are zero risk instruments. Therefore, the returns one gets on them are not attractive. Treasury bills come with different maturity periods like 3-month, 6-month and 1 year and are circulated by primary and secondary markets. Treasury bills are issued by the Central government at a lesser price than their face value. The interest earned by the buyer will be the difference of the maturity value of the instrument and the buying price of the bill, which is decided with the help of bidding done via auctions. Currently, there are 3 types of treasury bills issued by the Government of India via auctions, which are 91-day, 182-day and 364-day treasury bills.

2. Certificate of Deposits (CDs)

A Certificate of Deposit or CD, functions as a deposit receipt for money which is deposited with a financial organization or bank. However, a Certificate of Deposit is different from a Fixed Deposit Receipt in two aspects. The first aspect of difference is that a CD is only issued for a larger sum of money. Secondly, a Certificate of Deposit is freely negotiable. First announced in 1989 by RBI, Certificate of Deposits have become a preferred investment choice for organizations in terms of short-term surplus investment as they carry low risk while providing interest rates which are higher than those provided by Treasury bills and term deposits. Certificate of Deposits are also relatively liquid, which is an added advantage, especially for issuing banks. Like treasury bills, CDs are also issued at a discounted price and their tenor ranges between a span of 7 days up to 1 year. However, banks issue Certificates of Deposits for durations ranging from 3 months, 6 months and 12 months. They can be issued to individuals (except minors), trusts, companies, corporations, associations, funds, non-resident Indians, etc.

3. Commercial Papers (CPs)

Commercial Papers are can be compared to an unsecured short-term promissory note which is issued by highly rated companies with the purpose of raising capital to meet requirements directly from the market. CPs usually feature a fixed maturity period which can range anywhere from 1 day up to 270 days. Highly popular in countries like Japan, UK, USA, Australia and many others, Commercial Papers promise higher returns as compared to treasury bills and are automatically not as secure in comparison. Commercial papers are actively traded in secondary market.

4. Repurchase Agreements (Repo)

Repurchase Agreements, also known as Reverse Repo or simply as Repo, loans of a short duration which are agreed upon by buyers and sellers for the purpose of selling and repurchasing. These transactions can only be carried out between RBI approved parties Repo / Reverse Repo transactions can be done only between the parties approved by RBI. Transactions are only permitted between securities approved by the RBI like treasury bills, central or state government securities, corporate bonds and PSU bonds.

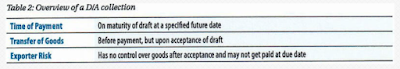

5. Banker's Acceptance (BA)

Banker's Acceptance or BA is basically a document promising future payment which is guaranteed by a commercial bank. Similar to a treasury bill, Banker’s Acceptance is often used in money market funds and specifies the details of the repayment like the amount to be repaid, date of repayment and the details of the individual to which the repayment is due. Banker’s Acceptance features maturity periods ranging between 30 days up to 180 days.