Solutions to Assignments

IBO - 04 - Export Import Procedure and Documentation

Master of Commerce (M.Com) - 1st Year

Question No. 4 Comment on the following statements:

(a) Export houses do not get any strategic advantages through EDI.

While Electronic Data Interchange (EDI) has been in use since the late 1960s, there are still many organizations that use their existing legacy systems for processing B2B transactions. Traditional B2B transactions like Purchase Order, Sales Order, Invoice, Advance Ship Notice, and Functional Acknowledgement often involve a series of steps to process. And processing these transactions involves many paper documents and a great deal of human intervention, which makes them prone to mistakes and human errors. But with the use of EDI, paper documents are eliminated and human intervention is minimized.

EDI enables organizations to automate the exchange of data between applications across a supply chain. This process ensures that business-critical data is sent on time. According to a market report by Dart Consulting, the estimated market size of EDI is expected to reach $1.68 billion by 2018, with projections reaching as high as $2.1 billion by 2020. But what are the advantages of EDI over traditional forms of business communication and information exchange?

To better understand these benefits, let’s take a look at some of them:

Benefits of EDI

Lower operating costs

EDI lowers your operating expenditure by at least 35% by eliminating the costs of paper, printing, reproduction, storage, filing, postage, and document retrieval. It drastically reduces administrative, resource and maintenance costs. EDI support can lower other costs as well, such as Matson Logistics who reduced their ASN fines 12% by switching to a more efficient EDI solution.

Improve business cycle speeds

Time is of the essence when it comes to order processing. EDI speeds up business cycles by 61% because it allows for process automation that significantly reduce, if not eliminate, time delays associated with manual processing that requires you to enter, file, and compare data. Inventories management is streamlined and made more efficient with real-time data updates.

Reduce human error and improve record accuracy

Aside from their inefficiency, manual processes are also highly prone to error, often resulting from illegible handwriting, keying and re-keying errors, and incorrect document handling. EDI drastically improves an organization’s data quality and eliminates the need to re-work orders by delivering at least a 30% to 40% reduction in transactions with errors.

Increase business efficiency

Because human error is minimized, organizations can benefit from increased levels of efficiency. Rather than focusing on menial and tedious activities, employees can devote their attention to more important value-adding tasks. EDI can also improve an organization’s customer and trading partner relationship management because of faster delivery of goods and services, as well as

Enhance transaction security

EDI enhances the security of transactions by securely sharing data across a wide variety of communications protocols and security standards.

Paperless and environmentally friendly

The migration from paper-based to electronic transactions reduces CO2 emissions, promoting corporate social responsibility.

(b) Documents against acceptance do not have a usage period.

Under Documents Against Acceptance, the Exporter allows credit to Importer, the period of credit is referred to as Usance, The importer/ drawee is required to accept the bill to make a signed promise to pay the bill at a set date in the future. When he has signed the bill in acceptance, he can take the documents and clear his goods.

The payment date is calculated from the term of the bill, which is usually a multiple of 30 days and start either from sight or form the date of shipment, whichever is stated on the bill of exchange. The attached instruction would show "Release Documents Against Acceptance".

Risk

Under D/A terms the importer can inspect the documents and, if he is satisfied, accept the bill for payment on the due date, take the documents and clear the goods; the exporter loses control of them.

The exporter runs various risk. The importer might refuse to pay on the due date because :

- He finds that the goods are not what he ordered.

- He has not been able to sell the goods.

- He is prepared to cheat the exporter (In cases the exporter can protest the bill and take the importer to court but this can be expensive).

- The importer might have gone bankrupt, in which case the exporter will probably never get his money.

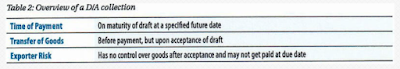

Documents against Acceptance Collection

With a documents against acceptance collection, the exporter extends credit to the importer by using a time draft. The documents are released to the importer to claim the goods upon his signed acceptance of the time draft. By accepting the draft, the importer becomes legally obligated to pay at a specific date.

At maturity, the collecting bank contacts the importer for payment. Upon receipt of payment, the collecting bank transmits the funds to the remitting bank for payment to the exporter. Table 2 shows an overview of this type of collection:

(c) Credit is a major weapon of international competition but it involves risk.

Competition in foreign markets is more keen than in the domestic market. Overseas customers are sought after by exporters from many countries. Competition is getting keener still due to an all round effort on the part of all countries to increase their exports', Indian exporters have to compete with exporters from other countries not only in respect of quality, price, delivery schedules, etc., but also in respect of payment terms. Their success would depend upon the ability to offer competitive terms of credit to the foreign buyer's terms of credit on par with Export Credit on par with those offered by exporters from competing countries. Risks are inherent in all credit transactions but more in export transactions. The fact that the buyer may not pay either due to insolvency or for any other reason exposes the exporter to the credit risk. Credit risk may arise even in cases where the buyer's credit standing has been thoroughly investigated. Too cautious an attitude in evaluating buyers may result in loss of hand to get business opportunities. Hence, credit risk is unavoidable specially in export business.

Credit risk is greater in export transactions because reliable information about foreign buyers is difficult to obtain and hence, it is difficult to evaluate their credit worthiness. Credit risk has assumed large proportions today not only because the volume of export transactions has become larger but also because far-reaching political and economic changes that are sweeping the world. An outbreak of war, civil war, coup or an insurrection may block or delay the payment for goods exported. Balance of payment difficulties may lead to transfer delays. And all this is possible even when the buyer is fully in a position to pay. In addition, one has to contend will1 the possibilities of the insolvency or protected default of the buyers. In recent years there has been a significant increase in insolvencies and business failures even in many developed countries. In such a high risk situation export credit insurance can be of immense help to (i) exporters and (ii) the banks who provide finance for the export transactions.

(d) Export incentives do not promote export.

Export incentives are certain benefits exporters receive from the government as acknowledgement for bringing in foreign exchange and as compensation for the costs they incur on sending goods and services out of the country. Export incentives can take the form of:

- Subsidies that lower export prices

- Tax concessions such as duty exemptions (which enable duty-free import of inputs for export production) and duty remissions (which enable post-export replenishment of duty on inputs used in export product)

- Credit facilities such as low-cost loans

- Financial guarantees such as provisions covering bad loans

In India, export incentives are in line with the government’s flagship “Make in India” and “Atmanirbhar Bharat” (Self-sufficient India) programmes. The former aims to transform India into a manufacturing major while the latter advocates self-sufficiency. These incentives are highlighted in a document called the foreign trade policy, which is a set of guidelines and strategies for the import and export of goods and services. The policy is formulated for a period of five years. The current one is valid till March 31. A new one will come into effect from April 1.

In India, the foreign trade policy and many of the export incentives it highlights are formulated and implemented by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry. Then there is the Central Board of Indirect Taxes and Customs (CBIC), which devises policy regarding the levy and collection of customs duty, central excise duties and Goods and Services Tax (GST). One of its arms, the Directorate General of Export Promotion (DGEP), deals with “refund issues arising out of export”, “looks into policy issues relating to export promotion schemes”, and recommends changes/improvements in customs-related procedures and policies. Furthermore, some financial incentives are implemented by the Reserve Bank of India, the country’s central bank.

A country’s export incentives might be considered as unfair trade practice by another country. When disputes arise between countries over the level of government involvement in foreign trade, these are settled by the World Trade Organisation (WTO). As a rule, the WTO discourages (even prohibits) government incentives barring those implemented by least-developed countries.

Why are export incentives important?

China’s success as an exporting nation lies in its manufacturers receiving a wide range of government incentives (including hefty tax rebates) to produce almost exclusively for foreign markets. Here’s how export incentives benefit countries and exporters:

- They bring in foreign exchange. Countries need foreign exchange reserves to make international trade transactions easier, pay for imports, pay back foreign loans, use as a cushion against economic collapse, currency devaluation and other such events, etc

- They create jobs by helping businesses grow and expand their workforce

- They create higher wages (especially for skilled, experienced and urban workers in India, as per this World Bank report)

- They lower the current account deficit, which is the deficit caused when a country imports more than it exports. India’s current account deficit has averaged 2.2% of GDP in the past decade (worth around $15 billion in July-September 2020)

- They encourage self-reliance by reducing dependence on foreign goods

- All of this means export incentives contribute to overall economic growth