Solutions to Assignments

IBO - 05 - International Marketing Logistics

Master of Commerce (M.Com) - 1st Year

Question No. 3 - Briefly comment on the following:

a) “Objectives and policies for functioning of the supply chain are usually in conflict both within and across operational units.”

Supply Chain Management refers to handling of the entire production flow of goods and services to maximize quality, customer experience and profitability. It involves right from the raw components to delivering the final product to customers. In this article we shall take a look at the objectives and functions of Supply Chain Management.

Objectives of Supply Chain Management

We have discussed some of the important objectives of SCM below.

1. To maximize overall value generated

The higher the SCM profitability, the higher is the success for supply chain. The Supply chain profitability is the difference between the amount paid by the customer to purchase a product and the cost incurred by an organization to produce and supply the product to the customer.

2. Cost quality improvement

This is another essential objective of SCM. It looks to achieve cost quality balance and optimization.

3. To look for sources of Cost and Revenue

Customer is the only source of revenue. Therefore there should be appropriate management of the flow of information, product or funds. It is a key to the success of supply chain.

4. Shortening the time to order

SCM aims to reduce the time required for ordering and fulfilling the same.

5. Delivery optimization

The SCM aims to meet the demands of the customer for guaranteed delivery of high quality and low cost with less lead time.

6. Demand fulfilment

Managing the demand and supply is a key yet challenging task for a company or management personnel. Its objective is to fulfil customer demand through efficient resources.

7. Flexibility

SCM aims for flexibility. A Well managed supply chain provides flexible planning and better control mechanism.

8. Better Distribution

SCM aims to ensure improved distribution. It can maximize the distribution side efficiency. Marketer or distributor can achieve optimized level distribution by using all resources that are available properly.

9. Cost Reduction

It’s another objective of SCM to reduce the system wide cost of a company to meet service level requirement.

Functions of Supply Chain Management

The functions of SCM include the following:

1. Purchasing

The first function of SCM is purchasing. During manufacturing process, raw materials are needed. It is essential that these materials are procured and delivered on time. Then only the production can begin. In order to make this happen, coordination with suppliers and delivery companies is needed to avoid delays.

2. Operations

Forecasting and demand planning is needed before materials are procured as the demand market shall dictate how many units are to be produced and how much material is needed for production. This function in SCM is vital as organizations accurately forecast demand to avoid having too little or too much inventory that would lead to revenue losses. Therefore, forecasting and demand planning should be tied in with inventory management, production and shipping.

3. Logistics

Logistics is a part of SCM that co-ordinates all planning aspects, purchasing, production, and transportation aspects to ensure that products reach the end consumer without hindrances. It is essential to have co-ordination with multiple departments so that products are quickly shipped to customers.

4. Resource Management

Resource management[1] ensures that right resources are allocated to the right activities and that too in an optimized way. It ensures that optimized production schedule is created to maximize operations efficiency.

5. Information workflow

Sharing information and distribution is that what keeps all other functions of supply chain management on track. If this information workflow and communication is poor, it can hurt the entire chain.

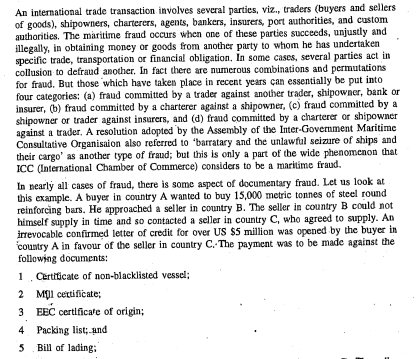

b) “The world economic situation and the world trade are very closely related.”

The world economic situation and the world trade are very closely related and

consequently whatever developments, whether positive or negative, take place in the former have

a direct impact on the latter. Hence, with the changing economic trends, it is very likely that the

movement of trade will also be affected. This results in the creation of cyclical fluctuation in the

demand and supply for goods in the world trade. Since the ships carry a sizeable quantity of goods

traffic in world trade, the fluctuations will have an impact on the movement of seaborne trade.

The global economic recovery that began in 1993 continued till 1996, when the world output grew

by 2.8% over 1995, However, growth belied the hopes that the world economy would enter a new

era of sustained growth not in excess of 3% which was expected to be achieved by 1997, Growth

in the developed market economies sf the world, as a whole, was slower than what had been

expected.

The growth of world merchandise trade slowed down sharply in 1996, it was 4.6% as against 10%

in the preceding two years, falling more than what had been expected at the beginning of the year.

The divergence between trade and output growth, which had been increasing since 1990, was

greatly reduced in 1996.

An important factor leasing to a slowdown in the world trade was a sharp deceleration of import

growth in developed countries, which account for about two-thirds of the world import demand from

11% in 1994 to only 5.2% in 1996.

The industrial production of the OECD countries is also a fundamental indicator for the global

maritime transport sector. The diverging growth rates in OECD countries industrial production and

world seaborne trade in the period 1991 -93 was mainly attributed to the decrease in production of

crude steel, iron ore, cooking coal, petroleum products, nonferrous metals and fertilizer, and to the

decline in the prices of these commodities. However, increasing trade in other manufacturers

maintained the growth of world seaborne trade.

c) “Shippers-Ship owners consultation arrangements in India leave much scope for Improvement.”

In India, All India Shipper's Council, regional level shipper's associations, and concerned Government department like the Ministry of Commerce regularly consult shippers. The US Government does the same through provisions of FMC( Federal Maritime Commission), established under the Shipping Act, 1916.

Currently, there are five association at the regional level for resolving shipper's problems:

a.) Eastern India Shipper Association (EISA), headquartered in Kolkata.

b.) Western India Shipper Association(WISA), headquartered in Mumbai.

c.) Southern India Shipper Association(SISA), headquartered in Chennai.

d.) South Western India Shipper Association(SWISA), headquartered in Cochin.

e.) North India Shipper Association(NISA), headquartered in New Delhi.

Shippers-shipowners consultation in India leaves much scope for improvement. The statement is true considering the following aspects:

1.) The consulting arrangements have been found to have inadequate secretarial staff and meeting space. These associations largely depending chambers for meeting space and staff.

2.) There is a lack of adequate resources to organize seminars, conferences, workshops for creating awareness.

3.) Not all shippers represent themselves in the association, hence negotiations and decisions represent only a part of the consultation.

4.) The association has no representative on the Board of trustees of ports.

5.) They lack the expertise to present the cases scientifically and objectively.

6.) At times, Shippers and Chamber of Commerce approach authorities directly. This hampers the growth and repute of associations.

d) The rate of return from warehousing business is low and the gestation period is rather long.

The Rate of Return (ROR) from warehousing business is low and the gestation period is rather long. Warehousing has several strategic decisions like the number of warehouses, warehouse capacity, their location, and type of ownership. These involve heavy investments.

A warehouse is involved in various functions like assortment, storage of goods, etc. These start generating revenue over and above the investment made, as the warehouse change for consignment held, as per the time period.

The cost of ownership of a warehouse involves initial cost and financing the same. Similarly, owing more warehouses would mean better customer service but involves ownership and maintenance costs. By making the product available at the place where it is needed and when it is needed, the distribution system adds both time and place utilities to the product. For achieving this, the company must critically decide on the number of warehouses and the type of transport system to be used for product delivery.