Solutions to Assignments

BCOE - 143 - Fundamentals of Financial Management

Section A

Question No. 1

Explain the meaning and objectives of financial management

CLICK HERE

Question No. 2

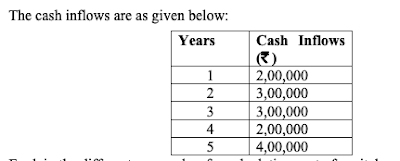

Calculate the NPV of a project which has an initial investment of Rs. 20,00,000/-, having a

life of five years. The cost of capital is 8%. Should the company accept the project?

Explain the reasons.

Question No. 3

Explain the different approaches for calculating cost of capital.

Question No. 4

From the following information, calculate the degree of financial leverage, degree of

operating leverage and degree of combined leverage of a firm:

Question No. 5

Explain Boumol’s Model and Miller and Orr’s Model of cash management.

Section B

Question No. 6

What is an operating cycle? Why is it important for the firm?

CLICK HERE

Question No. 7

What are the objectives of credit policy of a firm?

CLICK HERE

Question No. 8

What is economic order quantity? How is it calculated?

CLICK HERE

Question No. 9

Discuss the advantages of lease financing.

CLICK HERE

Question No. 10

Explain the concept of return.

CLICK HERE

Question No. 11

Write short notes on the following:

a) Valuation of convertible bonds

b) Internal Rate of Return method

c) Walter’s Model

d) Present Value

No comments:

Post a Comment